Contents

How U.S. Life Insurance Policies are Taxed

A whole life insurance policy is part investment and part life insurance. Such policies have two basic financial components – cash value and death benefit.

Insurance companies take policy premiums and invest them. The investments in turn are used to pay death benefits and “cashed out” policies.

The cash value of the policy increases as premiums are paid and as the investment grows. This investment portion of it is tax-deferred – no tax will be paid on the cash value unless the policy holder cashes out the policy.

The policy holder will pay a tax on the investment gain. The death benefit, or face value of the policy, is paid to the beneficiaries tax-free.

Insurance companies in the U.S. are heavily regulated as stock or mutual companies and policy holders receive deferred tax treatment on gain.

Foreign life insurance policies generally are not considered as qualifying life insurance products for U.S. tax purposes. Consequently, IRC 7702(g)(1) requires the policy holder of a foreign life insurance policy to report any inside gain each year.

Tax treatment of foreign life insurance policies

A whole life insurance policy is part investment and part insurance product. Taxation of such policies is determined based on the primary function of the policy.

Is it a qualifying life insurance policy?

IRC Code §7702 contains a two-pronged test. An insurance policy is non-taxable if it meets either (i) the cash value accumulation test or (ii) the guideline premium requirement and the specified cash value corridor.

(1) Cash Value Accumulation Test (CVAT)

The CVAT requires a fairly straightforward determination: does the cash value of the insurance policy exceed the present value of all future premium payments on the policy?

OR

A contract meets the guideline premium requirements of section 7702(c) if the sum of the premiums paid under the contract does not at any time exceed the greater of the guideline single premium or the sum of the guideline level premiums as of such time.

The guideline single premium is the premium that is needed at the time the policy is issued to fund the future benefits under the contract based on the following three elements:

- Reasonable mortality charges that meet the requirements (if any) prescribed in regulations and that (except as provided in regulations) do not exceed the mortality charges specified in the prevailing commissioners’ standard tables (as defined in section 807(d)(5)) as of the time the contract is issued;

- Any reasonable charges (other than mortality charges) that (on the basis of the company’s experience, if any, with respect to similar contracts) are reasonably expected to be actually paid; and

- Interest at the greater of an annual effective rate of six percent or the rate or rates guaranteed on issuance of the contract.

AND

(2b) Specified Cash Value Corridor

A policy falls within the cash value corridor if the death benefit of the contract at any time is not less than the applicable percentage of the cash surrender value. The applicable percentage is determined based on the attained age of the insured as of the beginning of the contract year, as follows:

| APPLICABLE PERCENTAGE | |||

|---|---|---|---|

| In the case of an insured with an attained age as of the beginning of the contract year of: | The applicable percentage shall decrease by a ratable portion for each full year: | ||

| More than: | But not more than: | From: | To: |

| 0 | 40 | 250 | 250 |

| 40 | 45 | 250 | 215 |

| 45 | 50 | 215 | 185 |

| 50 | 55 | 185 | 150 |

| 55 | 60 | 150 | 130 |

| 60 | 65 | 130 | 120 |

| 65 | 70 | 120 | 115 |

| 70 | 75 | 115 | 105 |

| 75 | 90 | 105 | 105 |

| 90 | 95 | 105 | 100 |

Tax on the Inside Buildup

If the policy does not meet either of the above tests, IRC § 7702(g)(1)(A) becomes applicable:

If at any time any contract which is a life insurance contract under the applicable law does not meet the definition of life insurance contract, the income on the contract for any taxable year of the policyholder shall be treated as ordinary income received or accrued by the policyholder during such year.

Therefore, the policy holder is subject to a tax on the increase in cash surrender value of the policy each year, even if the policy isn’t surrendered.

Treatment of amount paid on death of insured

If life insurance proceeds are received due to the death of the insured, the excess of the amount paid by the reason of the death of the insured over the net surrender value of the contract is taxable. IRC § 7702(g)(2).

International information reporting requirements

Foreign life insurance policies are reportable on both the FBAR and Form 8938. You would report the maximum cash surrender value during the year.

These reporting requirements are to the policy holder and not the beneficiary.

FinCEN 114 “FBAR”

U.S. persons owning foreign financial accounts with values in excess of $10,000 at any point during the year are require to file FinCEN 114, commonly known as FBAR with the Financial Crimes Enforcement Network (“FinCEN”) on a yearly basis.

“Foreign financial account” includes an account that is an insurance or annuity policy with a cash surrender value.

Form 8938 “FATCA”

Foreign life policies are also considered “specified foreign financial assets” for Form 8938 purposes and must be reported annually if the value exceeds the Form 8938 filing threshold.

U.S. Excise Tax

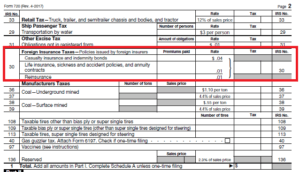

IRC §4371 requires policy holders to file a quarterly excise tax form (Form 720) to report and pay a 1% excise tax on insurance premiums paid to foreign life insurers.

Form 720 was meant for businesses to fill out for miscellaneous taxes such as transportation of persons by air, kerosene use, aviation gasoline, liquefied hydrogen, and other arcane items. Because the form was designed for businesses to fill out, it cannot be filed using an SSN. Policy holders must apply online for an EIN, solely for purposes of filling out this form and paying the excise tax.

At this time, it is not possible for a non-business taxpayer to get an EIN solely for purposes of reporting an excise tax on a foreign life insurance premium.

On the IRS’ website under EIN eligibility rules it states that “You may apply for an EIN online if your principal business is located in the United States or U.S. Territories.” And when you begin the EIN application, you are required to choose the type of business entity for which you are the responsible party.

Getting an EIN would require the taxpayer to falsify their purpose for applying for an EIN. We do not file them for clients but clients may do so if they wish. I have never seen a client contacted by the IRS for the failure to file this form for life insurance policies.

Form 8621 “PFIC”

If there’s any good news coming from this, it’s that foreign life insurance policies are usually not considered to be passive foreign investment companies.

There is no Form 8621 filing requirement if the holder of a life insurance contract does not have control over the available investment options and does not have any interest in the entity.

What should non-compliant taxpayers do?

If taxpayers are non-compliant with the foreign asset and income reporting requirements, they should consider applying to one of IRS’ voluntary disclosure programs:

- Voluntary disclosure program

- Streamlined domestic offshore program

- Streamlined foreign offshore program

- Delinquent international information return submission procedures

- Delinquent FBAR Submission Procedures

We assist taxpayers who have undisclosed foreign financial assets. Schedule an appointment to see how we can help.