FBAR penalties are assessed for both willful and non-willful violations. Penalties for willful violations carry significantly larger penalties.

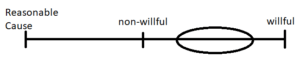

For clients wishing to correct past non-compliance, the most important determination is whether they are willful or non-willful.

While some actions are clearly willful, it is in that space between non-willfulness and willfulness where things get murky.

Contents

Willful FBAR Penalty Statute

An willful FBAR penalty under 5321(a)(5)(C) requires not just a failure to timely file but also evidence of willfulness.

(5)Foreign financial agency transaction violation.—

(A)Penalty authorized.—

(C)Willful violations.—In the case of any person willfully violating, or willfully causing any violation of, any provision of section 5314—

(i)the maximum penalty under subparagraph (B)(i) shall be increased to the greater of—

(D)Amount.—The amount determined under this subparagraph is—

When willfulness is established, the failure to timely file an FBAR will result in a maximum penalty that is the greater of (1) $100,000 or (2) 50 percent of the maximum balance in the accounts at the time of the violation.

Civil FBAR Penalty Cases

The concept of ‘willfulness’ as it applies to FBAR violations has evolved over time. Below are some of the seminal FBAR civil penalty cases. Caution for lay readers: there are many facts in these cases which are not included below. Most of these cases involve a number of “bad facts” such as accounts in tax havens (e.g., Switzerland) and large amounts of unreported income. The purpose of this exercise is to flesh out the legal standard for willfulness. Where does non-willfulness end and willfulness begin?

Cheek v. United States

Cheek v. United States, 498 U.S. 192 (1991), is a good place to start, although it is not an FBAR case, nor a civil penalty case. In Cheek, a tax protestor was convicted for the willful failure to file tax returns and tax evasion.

The Supreme Court in Cheek found that willfulness in a federal criminal tax case requires proof (1) that the law imposed a duty on the defendant that the defendant knew of this duty, and (2) that the defendant voluntarily and intentionally violated that duty. Earlier on, it was assumed that this same standard would apply to civil penalty cases, although with a lesser burden of proof. However, as we’ll see, subsequent FBAR cases have eroded the traditional willfulness requirement.

U.S. v. Williams

In U.S. v. Williams, 489 Fed. Appx. 655 (CA-4,2012), the government brought enforcement action to collect civil penalties assessed against Williams for failure to report his interest in two foreign bank accounts by failing to file an FBAR for tax period 2000.

Constructive knowledge

A taxpayer is considered to have constructive knowledge of all the contents of his income tax return by the mere signing of the Form 1040, which is signed under penalties of perjury.

Willful blindness

Evidence of acts to conceal income and financial information, combined with a taxpayer’s failure to pursue knowledge of further reporting requirements as suggested on Schedule B, provide a sufficient basis to establish willfulness blindness.

The takeaway from this case is that “willfulness” in the FBAR context includes not only knowing FBAR violations, but also willful blindness.

U.S. v. McBride

In U.S. v. McBride, 908 F.Supp. 2d 1186 (D.C. Utah, 2012), the government brought suit to collect a civil penalty assessed against McBride for his willful failure to report his interest in four foreign bank accounts for tax periods 2000 and 2001.

Constructive knowledge

The court adopted the Williams willful blindness standard and found that taxpayer’s signature on a return is sufficient proof of a taxpayer’s knowledge of the instructions contained in the tax return form and in other contexts (e.g. schedule B). Further, knowledge of what instructions are contained within the form is directly inferable from the contents of the form itself, even if it were a blank.

Recklessness

An individual’s actions may be deemed willful if the individual recklessly ignores the risk that conduct is illegal by failing to investigate whether the conduct is legal.

Because McBride acted in reckless disregard of the known or obvious risks created by his involvement with Merrill Scott (an offshore promoter) actual, subjective knowledge is not required for him to have willfully failed to comply with the FBAR requirements.

Therefore, even if McBride did not have actual, subjective knowledge of the FBAR requirements when he signed and filed his federal income tax returns for the tax years 2000 and 2001, the risk of failing to comply with the FBAR requirements was known or obvious.

McBride significantly expanded the concept of willfulness to include reckless violations and not only voluntary, intentional violations of a known legal duty. Williams and McBride have been criticized as having made the willfulness requirement superfluous and imposing strict liability by the mere act of signing a tax return.

U.S. v. Garrity

In United States v. Garrity, No. 3:15-cv-00243 (D. Conn. April 3, 2018), suit was brought to reduce to judgment an FBAR penalty assessed for the willful failure to file an FBAR.

Burden of proof = preponderance of the evidence

The court sided with the government in finding that willfulness need only be proven by a preponderance of the evidence rather than by clear and convincing evidence.

In its reasoning, the court relied on Supreme Court cases which held that the clear and convincing evidentiary standard only applies to matters that involve “important individual rights and interests.”

FBAR penalties, the court reasoned, only impose a financial burden and do not involve important individual rights and interest.

What should non-compliant taxpayers do?

If taxpayers are non-compliant with the foreign asset and income reporting requirements, they should consider applying to one of IRS’ voluntary disclosure programs:

- Voluntary disclosure program

- Streamlined domestic offshore program

- Streamlined foreign offshore program

- Delinquent international information return submission procedures

- Delinquent FBAR Submission Procedures

We assist taxpayers who have undisclosed foreign financial assets. Schedule an appointment to see how we can help.